Humans look at risk and reward in the context of their own personal financial position. We all look at risk differently, based on our varying life experiences and financial position.

Riskalyze is the first-ever way to objectively pinpoint individual investor risk tolerance. Furthermore, Riskalyze portfolio and retirement map functionality provide a quantifiable way to match investor risk preference with a corresponding portfolio and retirement plan.

The Riskalyze Risk Questionnaire process was built upon decades worth of behavioral economic work including but not limited to the academic framework called Prospect Theory that won the Nobel Prize for Economics in 2002.

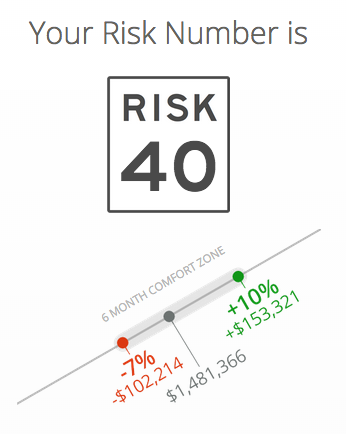

The Riskalyze Risk Number and corresponding risk/reward range empowers the advisor-client relationship with stated expectations.

Click Here to calculate your Risk Number.