4 Basics Every Estate Plan Should Include

When it comes to estate planning, most people don’t think they have enough assets to warrant planning of any sort. Unfortunately, this is just not true.

As in seeing any professional, it can make you feel a little queasy (Dentists, Accountants, Attorneys, (cough) Financial Planners), just getting the nerves to make the phone call and show up to the appointment can be tough enough. Let alone deciding on guardianship of your children or which child will get the desk that was built by your great-great-great aunt. These are not easy decisions, so avoidance of these conversations is “normal”.

However, with a little planning, this discussion will lead you into having your affairs “settled”, as they say, which for most people will allow them to begin to relax into daily life and not have to wake up in the middle of the night sweating about all of your assets going to the state or a distant relative you don’t know or like!

What are a few things that you can do to get started?

First, begin consolidating all your financial records and accounts. There are so many good financial management apps out there – Mint.com, Simplifi (by Quicken, my favorite…), and others. Or your financial planner will have tools for you to use to organize your records and accounts. You can’t master what you don’t manage, so begin getting a good picture of where everything is.

Secondly, you need to make sure that you have a few important documents in place, that would be used to execute a set of instructions in line with your wishes, should something catastrophic happen to you.

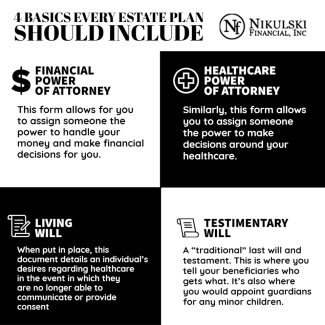

These are basic estate planning documents, that for a fee, can be created and put into place with very little work on your part. They include:

- Financial Power of Attorney

- This form allows for you to assign someone the power to handle your money and make financial decisions for you.

- Healthcare Power of Attorney

- Similarly, this form allows you to assign someone the power to make decisions around your healthcare.

- Living Will

- When put in place, this document details an individual’s desires regarding healthcare in the event in which they are no longer able to communicate or provide consent.

- Testamentary Will

- A “traditional” last will and testament. This is where you tell your beneficiaries who gets what. It’s also where you would appoint guardians for any minor children.

Next, one easy “estate planning” item that should be reviewed annually is how your beneficiaries are listed. These would include looking at any traditional or Roth IRA accounts, Insurance Policies, or annuities and ensuring that the current primary and contingent beneficiaries in place are still correct.

Life changes fast and unless beneficiaries remain updated, you may end up leaving your assets to someone you no longer wish would have them, or possibly in a form that you no longer wish to have them

Workplace savings plans (401k, 403b, etc.) are included in this list as well, so don’t forget about those!

One other tip on beneficiaries. Make sure you take time to think about who the contingent beneficiaries would be. Typically, one spouse lists the other spouse as the primary beneficiary but fails to list secondary or contingent beneficiaries. Take the time to do this.

Finally, when it comes to drafting these documents, take our advice and work with a legal firm that specializes in estate planning law. You want to make sure that if you’re taking the time and money, to create an estate plan, it’s created with clarity and correctness according to your wishes.

If you would like guidance on a few firms that we work with who really know their stuff, reach out to us and we’d be happy to share their contact info with you.